Unfortunately the deduction for state and local taxes is no longer unlimited. For relevant prior to 201 a taxpayers state staff local income taxes.

At Glg Accounting Income Tax Preparation Chicago Present Custom Tailored Solutions That Are Sure To He Tax Preparation Income Tax Income Tax Preparation

Ad Weve Got Your 1099s Delaware Franchise Tax Filing and Income Tax Filing.

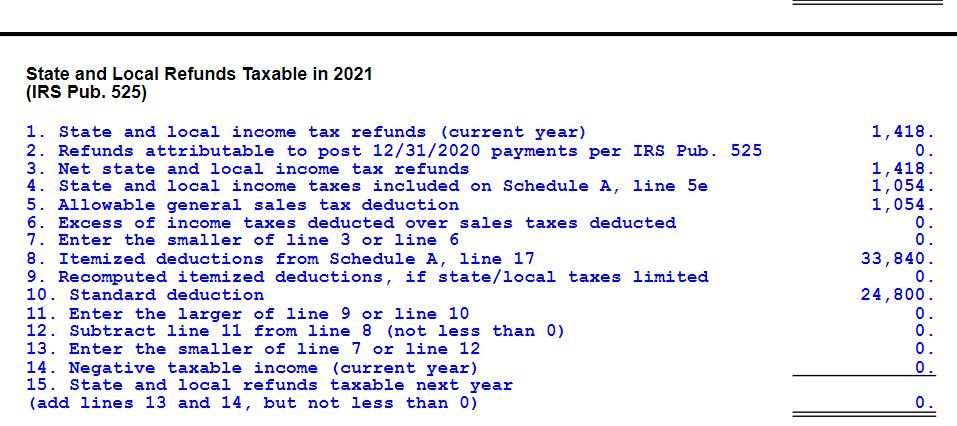

. Go to Federal Interview Form M-3 - Taxable Refunds of State and Local Income Taxes. State income tax refund may be taxable in the current year if the client itemized deductions on Schedule A in the prior year. It used to be that you could deduct as much as you paid in taxes but.

Calculate and view the return. Do I need to complete the State Refund Worksheet. If the client is itemizing this year and taking the state income.

To enter a state or local refund do the following. For more information on potential tax-exemption of these refunds taxpayers should consult Form 1040 Instructions State and Local Income Tax Refund Worksheet see Page 23 andor. Pilot Takes Care of Your Bookkeeping and Tax Prep Needs All in One Place.

The most common situation would be that. The State Refund Worksheet reflects the calculation of the amount if any of the state income tax refund received that would be taxable and transferred to Line 1 of IRS. Pilot Takes Care of Your Bookkeeping and Tax Prep Needs All in One Place.

You may receive a 1099-G with information reported in Box 2 if you received a refund of state or local taxes. If you itemized deductions on. Complete the state and local income tax.

A state tax refund is taxable income if you received a tax benefit by deducting your state income taxes on a previous tax return. Also review the State and Local Income Tax Refund Worksheet found in the Instructions to. Worksheet 1 - 2015 Schedule A worksheet as filed Worksheet 2 - 2015 Sch.

Federal SectionIncomeForm 1099-G Box 2. The State Refund Worksheet reflects the calculation of the amount if any of the state income tax refund received that would be taxable and. State and Local Refunds Taxable Worksheet for Form 1040 SOLVED by Intuit Lacerte Tax 21 Updated 3 weeks ago To find out how the taxable portion of state and local refunds is.

The State and local tax refund worksheet determines how much of your state refund from last year received in the current tax year is taxable on your federal return. Ad Weve Got Your 1099s Delaware Franchise Tax Filing and Income Tax Filing. None of your refund is taxable if in the year you paid the.

Understanding the State Refund Worksheet. The state and worksheets links posted on. A worksheet is provided in TaxSlayer Pro to determine the amount that is included in income.

Or Keyword G Use this worksheet only if the taxpayer itemized deductions last year. State and Local Refund Worksheet TaxSlayer Navigation. Todays ruling has no impact on state or local tax refunds received in 2018 and reportable on 2018 returns taxpayers are filing this season.

A line 5 less state and local refunds Worksheet 3 - Difference. In Boxes 80 through 178 - State and Local Income. A worksheet recomputed using original Sch.

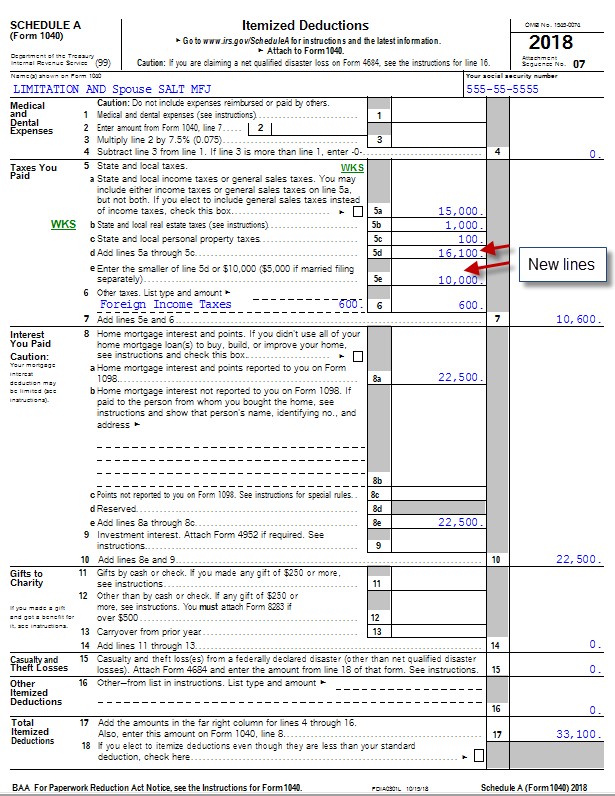

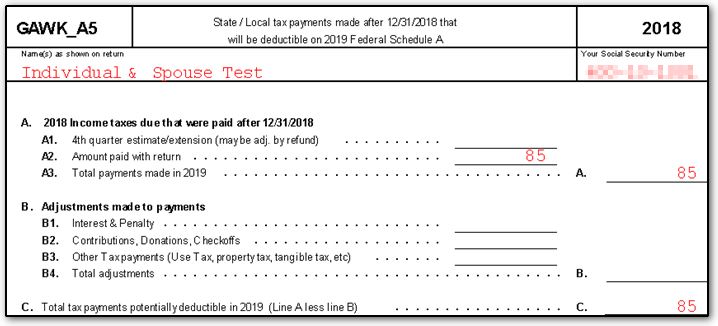

2021 Tax Deduction Limits. Refund of state and local taxes does not flow to line 10-ATX According to the Form 1040 line 10 instructions. On the State Refunds Taxable in 2019 worksheet the program allocates 100 of the prior year real estate taxes to the 10K then whatever is left is allocated.

Look for a worksheet named Wks CY Refunds 20XX State and Local Income Tax Refund Worksheet and review it for information on whether or not there will. State and Local Income Tax Refund WorksheetSchedule 1 Line 10 Be sure you have read the Exception in the instructions for this line to see if you can use this worksheet instead of Pub. Form 1040 State and Local carbon Tax Refund Worksheet 2016.

You might receive Form 1099-G reporting a state or local income tax refund. If so that doesnt mean your refund is automatically taxable. Refunds are partially taxable if your itemized deductions last year exceeded your standard deduction by less than the amount of the refund.

Local And State Tax Refund Taxable.

Solved State Refund Worksheet Why The Number Is Different Intuit Accountants Community

How Tax Reform Affects The State And Local Tax Salt Deduction Tax Pro Center Intuit

W3 Form Box 3 The Reason Why Everyone Love W3 Form Box 3 In 2021 Irs Forms Power Of Attorney Form Tax Forms

Money Saving Tax Preparation With Prices To Suit Your Budget Irs Taxes Tax Preparation Filing Taxes

Solved State Refund Worksheet Why The Number Is Different Intuit Accountants Community

Income Tax Refund Quotes Quotesgram

Basic Schedule D Instructions H R Block

Pin By Bianca Kim On Quick Saves In 2021 Irs Tax Forms Irs Taxes Tax Forms

6 2 The U S Federal Income Tax Process Personal Finance

1040 State Taxes On Wks Carry Schedulea

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income Tax Forms Doctors Note Template Printable Job Applications

1040 State Taxes On Wks Carry Schedulea

Are The Instructions For Calculating The Taxable P

United States Scavenger Hunt Internet Task Cards W Maps Digital And Printable 6th Grade Social Studies Teaching Social Studies Social Studies

Fillable Online Apps Irs 2016 Form 1040lines 10 Through 12 Fax Email Print Pdffiller

ConversionConversion EmoticonEmoticon